Legislative Bill 753 puts private schools over public schools

March 10, 2023

Legislative Bill 753 (LB 753), named the “Opportunity Scholarships Act,” is a proposal sponsored by Nebraska State Senator Lou Ann Linehan.

This bill would set aside up to $25 million in tax credits for individuals who give donations to Scholarship Granting Organizations (SGOs) that are linked with private schools. These donations would in turn be divvied out to the private schools across the metro area to aid in funding student scholarships that help cover the cost of tuition.

According to Tax Foundation, a tax credit is a provision that reduces a taxpayer’s final tax bill, dollar for dollar. For example, if someone donated $4000 to an SGO, the state would match their donation of $4000 in tax credits, meaning that the donor would pay $4000 less on their taxes.

Potential donors are, however, expected to put a cap on their generosity. Donations cannot exceed past the point of making someone’s tax credit cancel out more than 50 percent of their taxes.

Supporters of LB 753 claim that the bill will help give students access to “quality education.” Nebraska is one of two states in the country that does not extend public state funds to private schools, also known as “school choice.” Many believe that LB 753 will bring “school choice” to Nebraska.

Roncalli alumni, Moriah Dixson, is in support of LB 753 because she feels that private schools lack the support that public schools receive.

“I think it would be good because private schools don’t get money from the state,” stated Dixson.

Dixson could even see herself personally giving back to private education.

“I could see myself donating back to my school just because of the opportunities that [Roncalli has] given me,” said Dixson.

Though LB 753 has gained tremendous support from those who have positive experiences with private schools, the bill will undoubtedly do damage to public schools and is harmful in numerous ways.

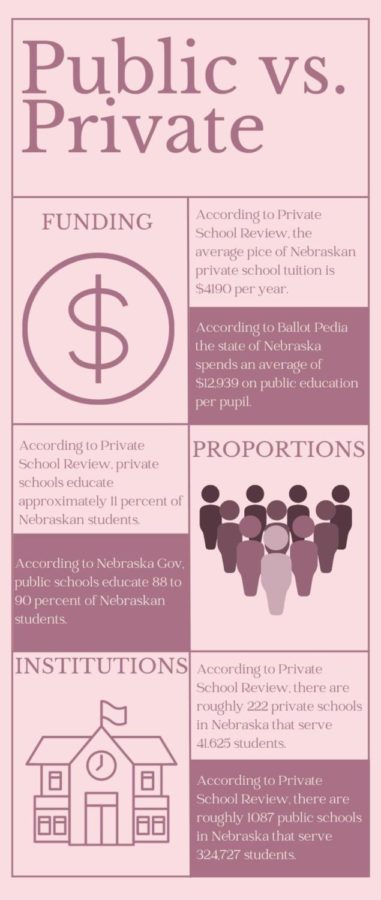

LB 753 will certainly take away funding for public schools. The $25 million set aside for tax credits is just $25 million dollars being taken away from public education. Public schooling is funded through tax revenue, and when taxpayers are given tax credits, funding is automatically lost.

Additionally, public schools receive money from the state for each of their students individually. The more students that transfer to private schools, the less money for public institutions.

The bill seems like a redundant do-over of real-life dynamics. While private schooling intuitions are mainly funded by student paid tuition, many also have generous donors that are there to back them.

Private schools were already able to offer scholarships to their students before the proposal of LB 753. These institutions have always had donor partnerships, with or without the promise of receiving a tax credit.

LB 753 would not only bring about more donations for private education, but they would also fill the pockets of those already donating. Those who are fortunate enough to be contributing funds to private schools most likely do not need to receive the luxury of a tax credit.

There are already many loopholes for wealthy individuals to cut down on their taxes and LB 753 would only add to the list.

Not only is giving out tax credits to individuals who donate to private institutions dangerous to the health of public schools, it also takes away the true meaning of a donation. Donations should be a free contribution, not made to get something in return.

“Is the whole point of your donation so you can get your money back?” asked Veronica Sargbah, 12. “I feel like [if] you’re trying to fund a student’s education, your reward or your prize for that is the student that you’re funding succeeding in school.”

There should also be no incentive in place to manipulate the placement of donations.

“It is not entirely clear why private schools are getting [a tax credit],” said Jane Erdenberger, member of Omaha Public School’s School Board. “Why isn’t it every [charitable organization]?”

Many see LB 753 as an initiative that will help low-income students get a quality education. Though if public schools are not seen as a quality education, there should be bills that are aimed toward building them up. It is disheartening to see no improvements made to public schools if those establishments are not “quality enough.”

The fact of the matter is that public schools are open to all students. No matter their capabilities or background, public schools will be there to educate them.

“[Private schools] get to pick and choose who they want in their schools, and that’s a big detriment to students who are looking to be successful,” said English teacher Corey Degner. “We as public schools have always been here, it doesn’t matter who you are, we take everyone.”

Not only would this bill increase inequities already seen in public schools, but it may also add to the bias that private schools exhibit. Many private school admission practices can be discriminatory, an example being the rejection of an applicant due to their gender or sexuality because of the school’s affiliation with religion.

LB 753 straddles on overstepping the boundary of separating church and state. Public funds should not be allocated to private institutions aligned with religion. Students should also not have to accommodate to a religious setting just to get a “quality education.”

“As a student who kind of identifies as being non-religious, a lot of private schools are paired up with religion, so I feel uncomfortable having to align with something that I don’t really personally believe in,” said Sargbah.

On top of being discriminatory, many private schools may lack the resources to help students with diverse needs to be successful. Public schools are equipped with programs that are built specifically for these students, like Individualized Education Plans (IEP) or Alternative Curriculum Programs (ACP). Several private schools have no programs of these sorts at all, leaving students behind and without support.

Overall, LB 753 is an outrageous and irresponsible bill that will further the neglection of public schools and the children they serve. In a time where public education is being continuously threatened, through bills such as “Don’t Say Gay” and many others, the “Opportunity Scholarship Act” is another detrimental blow.

“It’s such a huge, unfathomable, unsupportable disparity that I’m really kind of at a loss as to why anybody thinks it’s a good idea,” said Erdenberger.

To keep children taken care of and to keep the education that public schools offer at a quality level LB 753 must not pass.