EDITORIAL: Requirement changes make Personal Finance worth the cost

November 1, 2018

Starting with the class of 2019, seniors are required to take a semester long class called Personal Finance to be able to graduate.

As stated in Honors and Academic Personal Finance teacher Jonas Luedtke’s syllabus, this course aims to “review the most critical financial literacy concepts needed by consumers in today’s marketplace.”

“It’s also talking about institutions, financial markets, and giving the students a better understanding of the world around them and how they can use credit and finance as a tool to build equity,” Luedtke said.

Specifically, this class will teach students about the effect of personal financial decisions, money management skills, saving and investing, spending, credit, debt, and wealth.

“I say this with a passion, and with excitement, and because I truly believe it, without question students will grow in the finance classes…Even if they don’t know they are right away or on the surface level, subconsciously, at the very least, they will grow,” Luedtke said.

While this course’s objective is undoubtedly beneficial for students, the class itself has been causing scheduling conflicts with students enrolled in AP American Government, according to Leah Burbach, the AP American Government teacher.

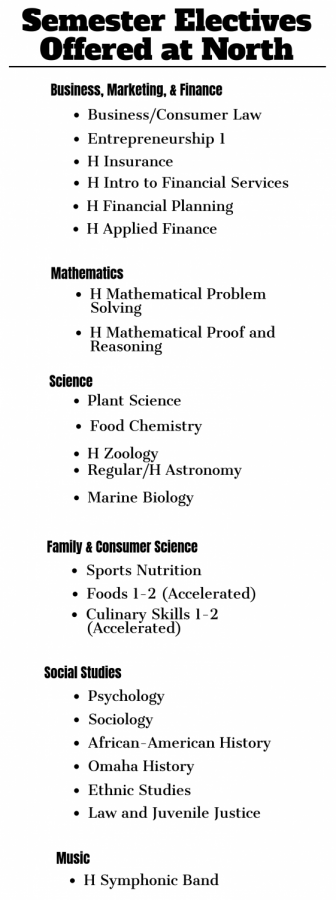

Academic American Government is only a semester long, whereas AP American Government is a whole year long. If a student were to take AP instead of academic, they would then need to match their Personal Finance class with another semester class to fill their schedule. Essentially, with Personal Finance being added, students who are enrolled in AP lose a block when they could be taking another class.

The number of students enrolled in AP American Government this year compared to last year decreased by more than half. This year there are only 15 seniors in one block of AP, whereas last year there were a total of 48 students split between two blocks.

This is the issue that caused Burbach’s students to almost not take AP. She said some of her students will have to take “random classes” second semester that they don’t want to take to match with personal finance.

There are going to be schedule conflicts with any extra required class, so the best way to fix this is to have personal finance simply be required to graduate but can be taken at any grade level. This is similar to how Human Growth and Development is setup, however students cannot opt-out of Personal Finance.

Luedtke thinks it would be ideal for students to take Personal Finance after they have some sort of background in economics.

“I believe students need to have a good grasp on economics prior to taking finance… you’ve got to know economics, you’ve got to know scarcity, unlimited wants, limited resources…you don’t have to be an expert in it, but having a basic understanding of that is very, very important to go into finance,” Luedtke said.

Taking this into consideration, a student should take Economics at the same time or before they take Personal Finance to ensure that they have the background knowledge necessary to succeed in Personal Finance. This would mean that students would ideally take Personal Finance as a sophomore or older.

Having the option to take Personal Finance at any grade level would help eliminate the extra stress of senior year as well as allow students with the most possible time to apply their knew knowledge of finance to the real world. With college approaching rapidly for seniors, it would help if they already knew the basics of finance because then it would be easier to prepare for loans, scholarships, savings, etc.

Not only will learning about personal finance while students are young help them when preparing for college, but it will also help them in their daily life as adults. According to U.S. News & World Report, students with higher financial literacy have higher credit scores, lower debt delinquency rates, and are linked to wealth accumulation and stock market participation.

While the Personal Finance classes are only just beginning at Omaha North, it is clear that, when offered early enough, they will provide students with the necessary information needed for them to succeed and use their money to their advantage.